Day trading is a dynamic and exhilarating approach to financial markets, where traders aim to capitalize on short-term price fluctuations within a single trading day. Mastering the art of day trading requires a combination of skill, discipline, and a deep understanding of market dynamics. In this article, we’ll explore key strategies that can contribute to success in the fast-paced world of day trading.

Understanding the Basics:

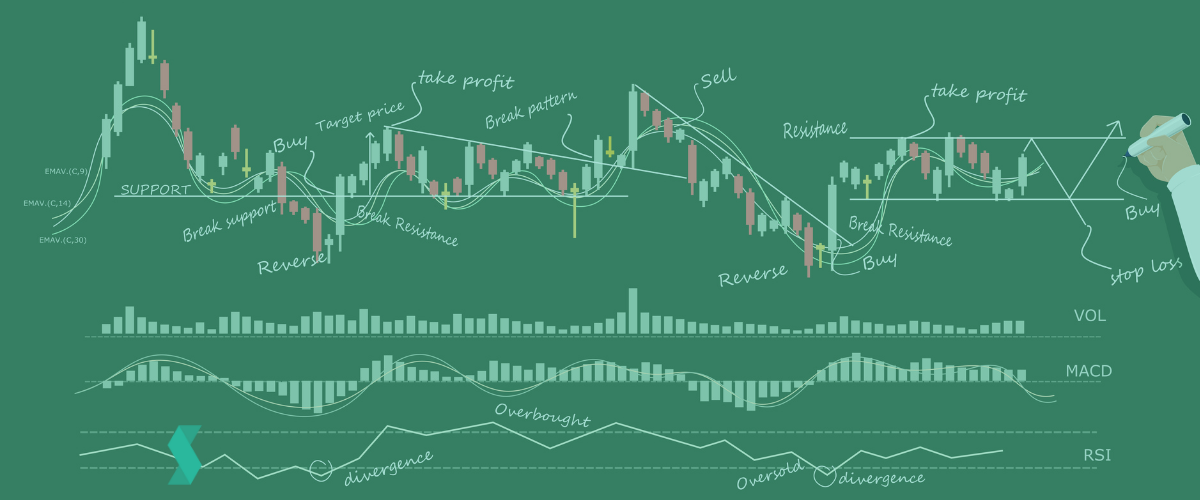

To excel in day trading, one must first grasp the fundamentals of the financial markets. This includes a solid understanding of technical analysis, chart patterns, and the ability to interpret market indicators. Day traders often rely on technical tools such as moving averages, relative strength index (RSI), and stochastic oscillators to make informed decisions.

Risk Management:

One of the critical aspects of day trading is effective risk management. Given the volatile nature of intraday price movements, losses can accumulate rapidly. Successful day traders implement risk-reward ratios, set stop-loss orders, and establish clear exit strategies. By limiting potential losses and maximizing gains, traders can enhance their overall profitability.

Choosing the Right Stocks:

Not all stocks are suitable for day trading. Liquidity is a key factor, as it ensures that traders can enter and exit positions easily. Day traders often focus on stocks with high average daily trading volumes and tight bid-ask spreads. Additionally, news and catalysts can significantly impact stock prices, making it essential for day traders to stay informed about market developments.

Technical Analysis Strategies:

Day traders heavily rely on technical analysis to identify entry and exit points. Popular technical strategies include trend following, momentum trading, and reversal patterns. Candlestick patterns, support and resistance levels, and moving averages are tools commonly used to analyze price charts and make timely decisions.

Continuous Learning and Adaptation:

The financial markets are dynamic, and successful day traders continuously update their knowledge and adapt to changing conditions. This may involve staying informed about economic indicators, central bank decisions, and global events that can influence market sentiment. Additionally, embracing new trading technologies and tools is essential to remain competitive in the evolving landscape of day trading.

In conclusion, mastering the art of day trading requires a combination of technical proficiency, risk management skills, and adaptability. While the potential for profit is high, so is the risk. Aspiring day traders should approach the market with a clear strategy, a commitment to continuous learning, and the discipline to stick to their trading plan.